Get Globally Qualified as a Chartered Certified Accountant

Pursue the ACCA credential with AKPIS Professionals & build an international career in accounting, finance & audit

Globally Recognized | 13 Papers | Flexible Online Format | Career-Focused Training

- Live Sessions with CA CPA Shammi Sir

- Specially for Students & Working Professionals

- Pass all 13 papers

- 8 LPA for Freshers

Our students working in MNC's

Demand for ACCA-Qualified Professionals

Job opportunities

- Financial Accounting & Reporting

- Audit & Assurance

- Taxation & Financial Management

- Risk, Compliance & Internal Controls

- Business Advisory & Consulting

Demand

Global Hiring in 180+ Countries

ACCA professionals are in growing demand across multinational companies, Big 4 firms, and global finance hubs—driven by the need for experts in IFRS, auditing, and strategic finance.

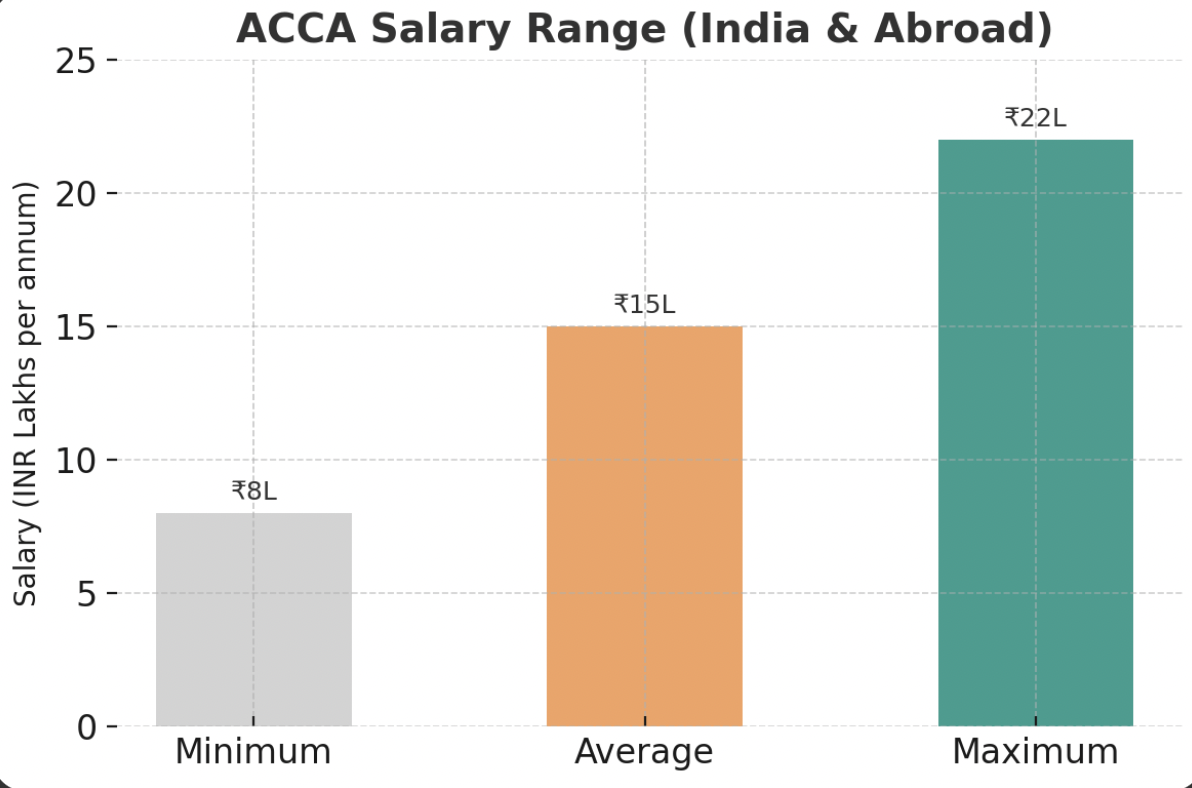

Salaries

Higher earning potential with Big 4, MNCs, and leadership roles in finance

The global finance landscape is rapidly transforming—and employers are actively seeking professionals with internationally aligned qualifications like ACCA. With a flexible structure, practical focus, and global recognition, ACCA equips you for high-paying roles in today’s most competitive industries.

Accelerate your accounting career, become ACCA-certified, and unlock worldwide opportunities in finance.

Why Pursue ACCA?

The Association of Chartered Certified Accountants (ACCA) is one of the most respected global qualifications in accounting and finance. Recognized in over 180 countries, the ACCA credential prepares you for high-growth roles in audit, taxation, financial reporting, and management.

Globally recognized by over 7,400 employers

Ideal for roles in finance, audit, taxation, and consulting

Flexible structure – complete at your own pace

Higher salary potential and better career stability

Do you Struggle

to make your Accounting career global?

Limited Growth Opportunities

Struggling to stand out in a competitive job market without globally recognized credentials.

Lack of In-Demand Skills

Missing advanced financial, analytical, and leadership skills that top employers expect today.

Uncertain Career Direction

Confused about the right path to secure high-paying, stable, and future-proof job roles.

ACCA Course Syllabus

Curriculum

The ACCA qualification is divided into 3 levels and 13 papers in total.

Gain a strong foundation in accounting and business concepts.

1. Business and Technology (BT)

- Business organisation structure

- Corporate governance

- Business ethics

- IT and communication

2. Management Accounting (MA)

- Budgeting and forecasting

- Cost classification

- Performance measurement

3. Financial Accounting (FA)

- Financial statements

- Bookkeeping

- Double entry

- Trial balance

Develop practical skills in core accounting disciplines.

4. Corporate and Business Law (LW)

- Legal systems

- Contract and employment law

- Governance and ethics

5. Performance Management (PM)

- Variance analysis

- Strategic planning

- Decision making techniques

6. Taxation (TX)

- Income tax

- Corporate tax

- VAT and indirect taxes

7. Financial Reporting (FR)

- Financial statements

- IFRS application

- Consolidated reports

8. Audit and Assurance (AA)

- Audit process and standards

- Risk and internal controlAudit evidence

9. Financial Management (FM)

- Investment appraisal

- Working capital

- Business valuations

Focus on strategic vision and advanced knowledge.

Essentials (Mandatory):

10. Strategic Business Leader (SBL)

– Leadership

– Corporate governance

– Strategy formulation

11. Strategic Business Reporting (SBR)

- Complex financial reporting

- Ethical reporting frameworks

- Integrated reporting

Optional (Choose any 2):

12. Advanced Financial Management (AFM)

13. Advanced Performance Management (APM)

14. Advanced Taxation (ATX)

15. Advanced Audit and Assurance (AAA)

ACCA Course Exemptions

While there are 13 papers in total that an individual has to complete in order to get qualified for ACCA, there are various exemptions that are offered to individuals depending on their academic qualification levels. The following table describes the ACCA course exemptions at various levels:

| Academic Qualification | Exempted Papers |

|---|---|

| Class 12th | None of the papers are exempted. All 13 papers must be attempted to qualify. |

| Graduation |

B.Com: Exempted up to 5 papers BBA: Exempted up to 3 papers |

| Foundation CA |

Without graduation: No exemption With graduation: 3 to 5 papers can be exempted |

| Inter CA |

Up to 5 papers can be exempted With B.Com: Up to 6 papers |

| Final CA | Exempted from up to 9 papers |

| CA Qualified | Exempted from 9 papers |

Premium Features of the ACCA Certification Course

ACCA Certification Training Highlights

Expert Faculty

AKPIS Professionals connects you with hiring partners, including Big 4 companies and global corporations for internships and jobs.

Comprehensive Study

Access updated study materials, live sessions, recorded classes, and personalized doubt-clearing sessions every week.

1:1 Mentorship Sessions

Get dedicated mentorship with Shammi Sir to help you choose your ACCA discipline, prepare for exams, and plan your career path.

Placement Assistance

AKPIS Professionals connects you with hiring partners, including Big 4 companies and global corporations for internships and jobs.

Flexible Learning Options

Online, weekend and evening classes available to suit working professionals and full-time students alike.

End-to-End Journey Support

From eligibility evaluation and state board selection to exam registration and licensing, AKPIS guides you through every step.

Who is this Masterclass for ?

Students & Graduates

This course is for 12th pass students in the Commerce stream & graduates of B.Com, M.Com, BBA, and MBA programmes.

Working Professionals

Working professionals in accounting or finance. CA aspirants looking for a global qualification

Global Opportunity Seekers

Those who want to qualify for Big 4 firms, MNCs, or international finance roles across the US, Middle East, Europe, and Asia.

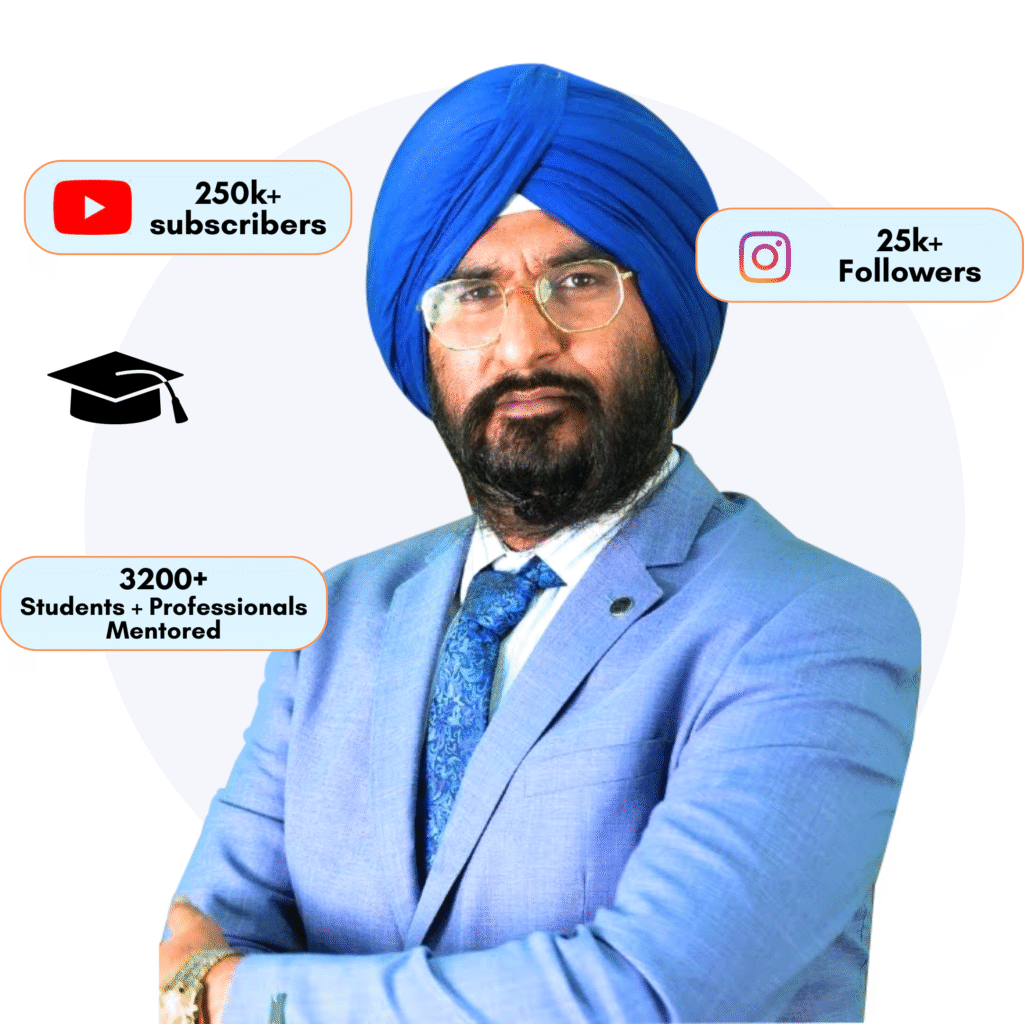

Meet your Mentor

CA+CPA Shammi Singh Saluja

With over a decade of experience in the field of finance, accounting & professional education, CPA Certified Shammi Singh Saluja has mentored and guided more than 1,00,000+ students & working professionals towards achieving their academic and career goals.

A highly respected educator, mentor, and coach, Shammi Sir is known for his practical teaching approach, deep subject knowledge, and student-first philosophy that makes complex concepts easy to understand for learners from all backgrounds.

"Every student has the ability to succeed with the right direction, strong fundamentals, and consistent guidance."

CPA Shammi Singh Saluja

250K+

subscribers

25k+

followers

3k +

followers

Why AKPIS Professionals?

Why 100,000+ Students & Working Professionals Trust AKPIS Professionals for Their Certification Journey

Proven Track Record of Global Placements

Students placed in Big 4s, Fortune 500s, and MNCs globally.

Career Guidance from CPA Shammi Sir

1:1 mentorship tailored to your goals and background.

Expert Faculty with International Credentials

Learn from qualified CPAs, CMAs, CIAs, and tax professionals.

US Taxation & Accounting Focus

Specialized training designed for high-demand US accounting jobs.

Flexible Live + Recorded Class Options

Attend at your convenience with lifetime access to resources.

Complete Support for Exam Registration & Licensing

End-to-end guidance from application to certification.

Doubt-Solving & Mock Tests Included

Weekly doubt sessions, full-length tests, and performance tracking.

Global Curriculum Aligned with Job Roles

Curriculum mapped to real-world accounting and audit jobs.

Community of 100,000+ Successful Learners

Be part of a growing alumni network and peer support system.

Sample Demo Lectures

Frequently Asked Questions

ACCA stands for the Association of Chartered Certified Accountants, a UK-based global body offering the Chartered Certified Accountant qualification, recognized in over 180 countries.

Students who have completed 10+2 with commerce background, or graduates in accounting, finance, or business are eligible. You may get exemptions based on your qualifications.

There are 13 papers divided across three levels: Applied Knowledge, Applied Skills, and Strategic Professional. Some students can get exemptions for up to 9 papers.

Typically, students complete ACCA in 2–3 years, depending on the number of papers, exemptions, and exam scheduling.

Yes, ACCA is accepted by over 7,400 employers worldwide and is recognized in countries like the UK, UAE, Singapore, Australia, and more. In India, many MNCs and Big 4 firms hire ACCA-qualified professionals.

Yes, we help students with exam registration, exemption guidance, membership application, and other ACCA-related formalities.

Yes, ACCA’s flexible format makes it ideal for students and working professionals. Our online classes fit easily into your schedule.

An ACCA-qualified professional in India can earn anywhere from ₹6 LPA to ₹15 LPA, depending on experience and company.

Yes, AKPIS provides career counseling, resume building, and interview prep to help you secure roles with top employers.

Exams are conducted by ACCA four times a year and can be taken online or at designated centers, depending on the paper.

TESTIMONIALS

47,000+ students have already transformed their careers

Confused to make decision?

Get step-by-step guidance, real-world learning, and complete career support — all designed for your success.